Business Insurance in and around Seattle

Calling all small business owners of Seattle!

This small business insurance is not risky

Help Protect Your Business With State Farm.

Sometimes the unpredictable is unavoidable. It's always better to be prepared for the unfortunate accident, like a customer stumbling and falling on your business's property.

Calling all small business owners of Seattle!

This small business insurance is not risky

Protect Your Future With State Farm

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like errors and omissions liability or a surety or fidelity bond, that can be created to develop a personalized policy to fit your small business's needs. And when the unexpected does occur, agent Derek Chambers can also help you file your claim.

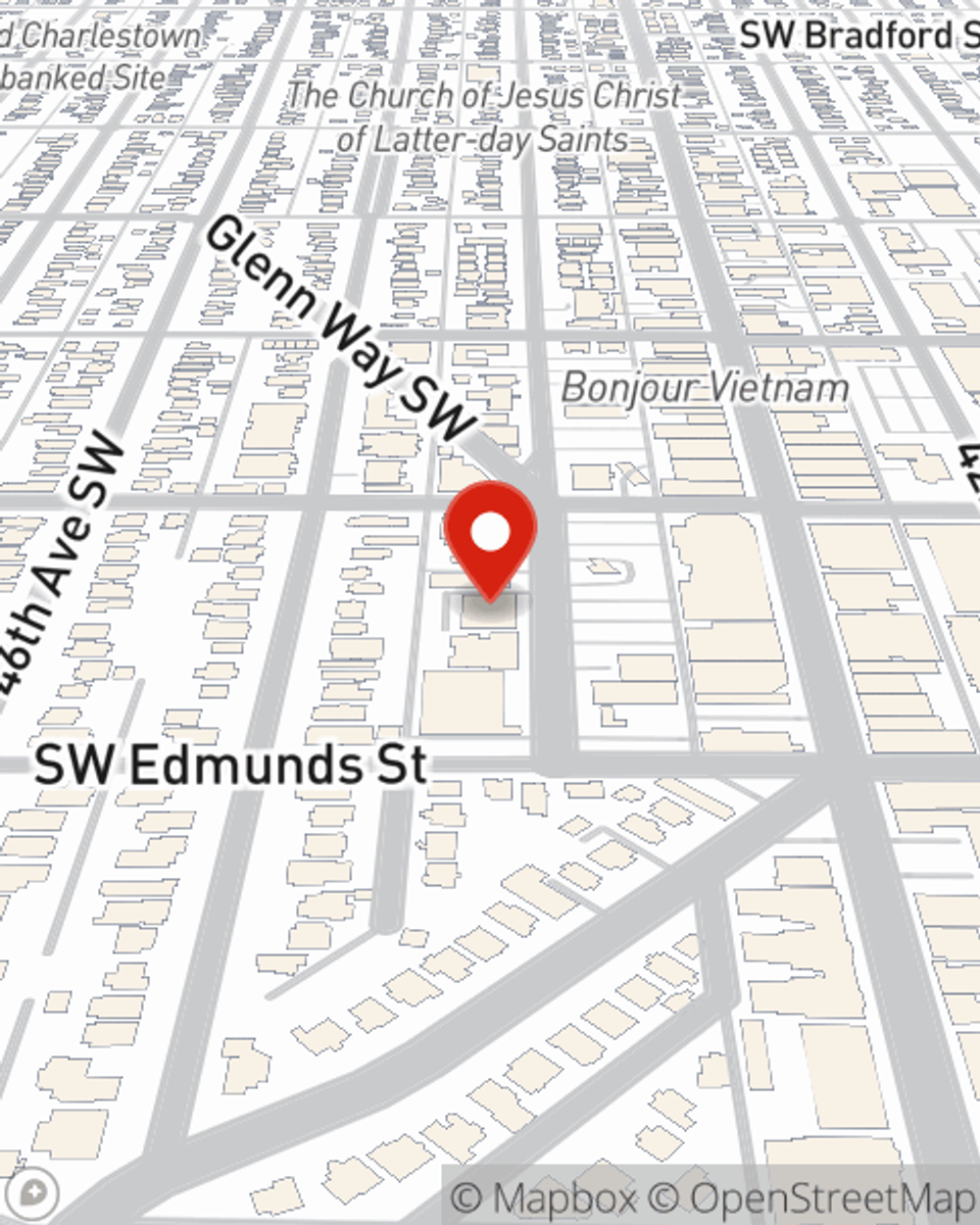

Ready to research the specific options that may be right for you and your small business? Simply call or email State Farm agent Derek Chambers today!

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Derek Chambers

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.